Traditional Breakeven point thinking

We tend to think of break even point as a static number. We store away a number in our head that we know we’re aiming for in order to ‘break even’. I need to make $X revenue per week, month or year to cover every cost of business. And every dollar after that is profit.

This is a useful concept to bear in mind, especially when performing early feasibility tests on a new venue. But it’s not useful when it comes to the day-to-day work of operating, refining and consistently improving business and profit margins.

Why? Because it’s static.

How static breakeven points are hurting the industry

And as anyone who has an inkling about hospo will tell you, not much else in this industry stays static. Especially when it comes to money. Revenue and costs are changing, every minute of every day.

Teams change, menus change, COGS and labour costs change, electricity bills change, and so on and so forth. There are not many numbers that don’t change, even from one day to the next. So no matter how carefully you arrange your workflows around a static benchmark, something is absolutely going to change unexpectedly and throw out your math.

And just like the dynamic benchmarks themselves, we think of budgets (which are essentially the outcome of calculating break even according to a benchmark) as static numbers. E.g. Budget for this week’s purchases: $10K. That’s because we guess NET revenue to be $33K, and we’re looking for a benchmark around 30%.

But what happens if the week is half over and you’re not on track to meet your $33K expectation? Or if you’re now heading for $35K and your $10K budget will leave you under-supplied. The revenue changed – so the budget must change.

Our static vision is stopping us from consistently building profit. It’s the reason the industry standard profit is <6%, and the average margin for coffee shops is coming in at a measly 1.9%.

How can I use dynamic breakeven point?

We need to see breakeven through a new lens – a dynamic lens. Everything must be dynamic and adapt to revenue as that revenue changes. Otherwise our industry will continue to suffocate under the pressure of increasing costs.

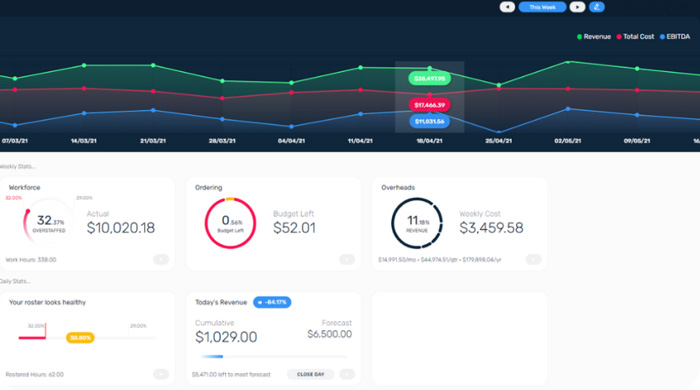

As revenue changes each moment of each day, so too should our budgets change, in line with benchmarks. But no one is going to sit down and recalculate the week’s ordering budget or roster target at the end of each service based on how the takings ended up. You’re working with a moving target, so you’d need to constantly keep changing aim every service. Manually calculating that would be a total drag, and quick frankly it’s a drag we don’t have time for.

The only realistic way to do this effectively is with modern technology. Forget spreadsheet formulas. Definitely throw any thought of manual calculations out the window. Go straight to a smart software that knows your business inside out and can recalculate second-to-second.

With a solution that can track dynamic changes as they happen, you get live feedback about how your dynamic benchmarks and budgets should respond to expected revenue forecasts. With this feedback, you can keep your costs in line with revenue, and your profit margin will remain at a healthy percentage of your takings, meaning that your targets are consistently met, day after day.